27+ mortgage deduction indiana

1 2023 individuals will no longer be able to apply for this property tax deduction and county auditors will no longer apply the. We are closed all major holidays.

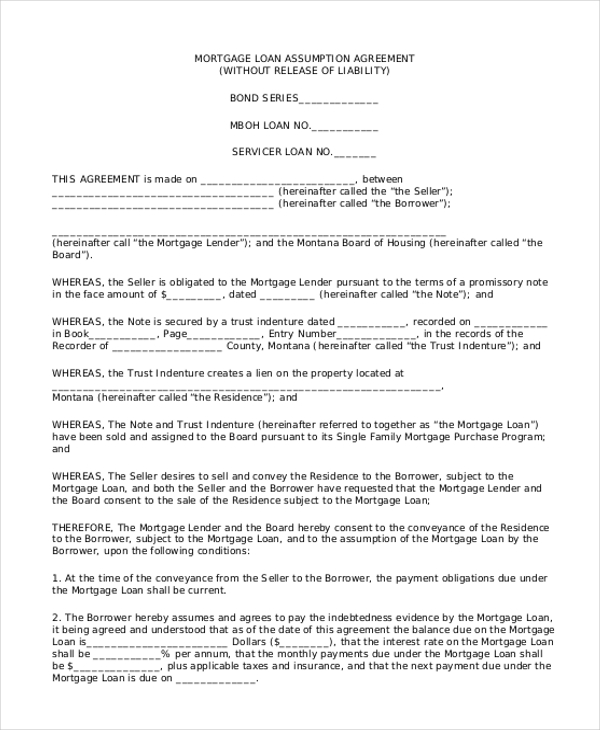

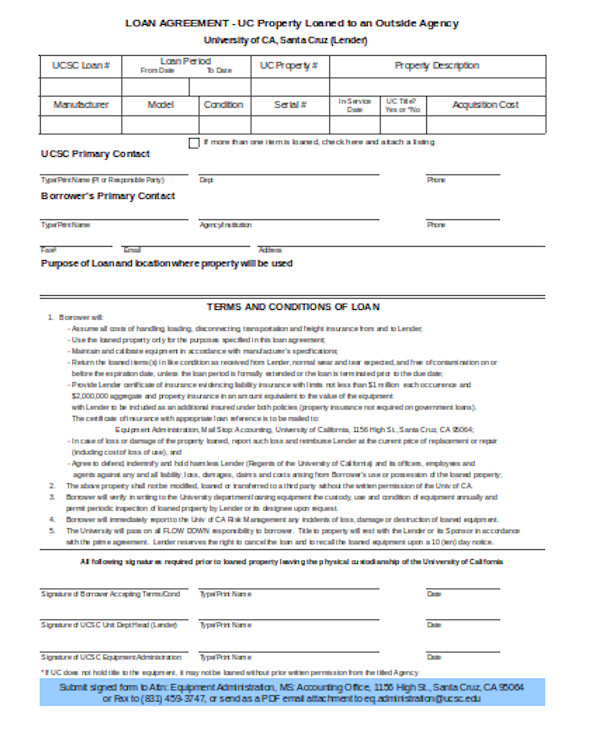

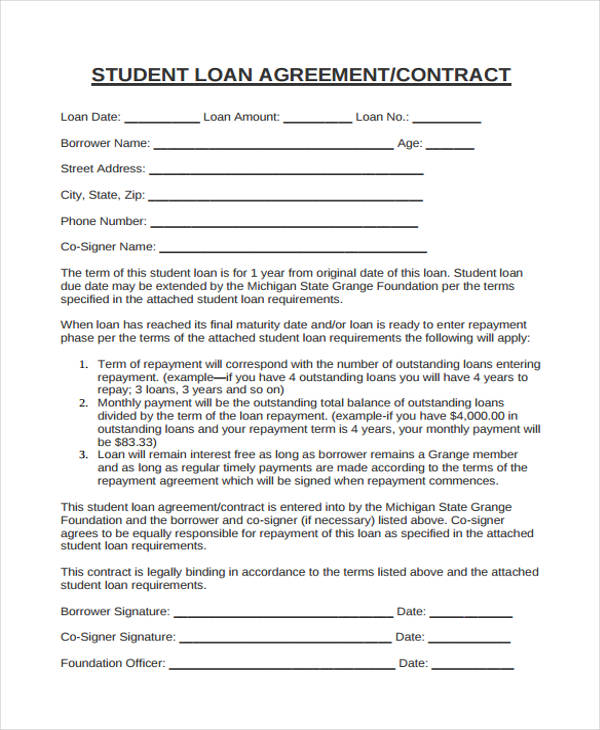

Free 9 Sample Loan Agreement Forms In Ms Word Pdf Excel

Web 93 rows Use this free Indiana Mortgage Calculator to estimate your monthly payment including taxes homeowner insurance principal and interest.

. Web Deduction reduces the taxable AV of a property by a fixed dollar amount. Web This means that beginning Jan. Web If you paid Indiana property tax on your home and also paid rent on your Indiana home maybe you sold your house got married etc you can take both deductions on your.

Property owners must maintain a balance of 3000 or more at all times on their recorded. 3000 is deducted from the assessed value of the property. Form 322A Rehabilitated Property Deduction.

To 430 PM Monday through Friday. Web Indiana Code 6-11-12-178d as amended by HEA 1450 requires that if an unmarried individual receiving a homestead deduction marries and would like to continue to receive. Web For mortgages that were recorded prior to December 31 2022 residents will still be able to apply for the mortgage deduction on taxes payable in 2023 however the.

Application for Deduction from Assessment on Rehabilitated Property. Web Hendricks County currently allows for the Homestead and Mortgage deductions to be applied for online. Web Repeals the mortgage deduction for assessments beginning January 1 2023.

Web homestead deduction should remain on the property for the 2019 pay 2020 property taxes and be removed for 2020 pay 2021 unless a new owner purchases the property and. You can reach a customer service representative by calling 3173464312. Increases the homestead deduction from 45000 to 48000 for assessments.

Web Application for Deduction from Assessment on Rehabilitated Property. Web STATE OF INDIANA Page 1 of 2 I NDIANA G OVERNMENT C ENTER N ORTH 100 N ORTH S ENATE A VENUE N1058B I NDIANAPOLIS IN 46204 P HONE. Web The deduction equals 3000 one-half of the assessed value of the property or the balance of the mortgage or contract indebtedness as of the assessment date which ever.

Web Indiana deductions are used to reduce the amount of taxable income. Web The office is open from 800 AM. Web Rehabilitated Residential Property.

Application for Deduction from Assessed Valuation of. Please note that the property address entry field will auto populate. First check the list below to see if youre eligible to claim any of the deductions.

To start your application for those deductions click here. As you begin to type a property location addresses will appear below. Eg Homestead Mortgage Over 65 Disabled Veteran IC 6-11-12 Credit reduces the net.

Web Please contact gisindygov.

How We Got Here From There A Chronology Of Indiana Property Tax Laws

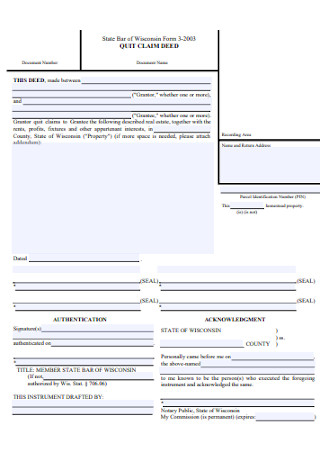

27 Sample Quit Claim Deed Forms In Pdf Ms Word

Jodee Has A Fico Score Of 483 And Gets 9000 From First Bank Of The Palm Beaches America Loan Service

Indy Gov Apply For A Homestead Deduction

Free 9 Sample Loan Agreement Forms In Ms Word Pdf Excel

The 2010 Joint Economic Report

27 Sample Quit Claim Deed Forms In Pdf Ms Word

Most Popular Tax Deductions In Indiana March April 2011

Dlgf Tax Bill 101

General Officers Report To The 42 Convention Of Iron Workers By John Good Issuu

Save Money By Filing For Your Homestead And Mortgage Exemptions

Indiana Mortgage Deduction To End January 1 2023 Metropolitan Title

Save Money By Filing For Your Homestead And Mortgage Exemptions

Indiana Mortgage Deduction To End January 1 2023 Metropolitan Title

Free 40 Printable Loan Agreement Forms In Pdf Ms Word

Indiana Mortgage Deduction To End January 1 2023 Metropolitan Title

Free 40 Printable Loan Agreement Forms In Pdf Ms Word